The Power of Relative Strength: A Simple Guide to Smarter Investing

Investing might seem like a game of numbers and graphs, but it’s really about making smart decisions. One powerful method that can help you make better choices is called relative strength investing. This approach is all about identifying which stocks or investments are performing better than others. If you’re wondering how you can use this strategy to boost your returns, you’re in the right place. Let’s break it down!

What is Relative Strength in Investing?

At its core, relative strength is a method of investing that focuses on identifying stocks or assets that are doing better than others. Instead of just looking at how a stock performs on its own, relative strength compares its performance to others in the same group or market. This helps you find the “winners” who are outperforming everyone else.

Think of it like a race: instead of just looking at how fast each runner is going, relative strength helps you focus on the fastest runner in the race. This strategy helps you pick investments that are already ahead and likely to keep doing well.

How Does Relative Strength Work?

Relative strength uses three main ideas to help you spot top-performing investments:

- Momentum: This is the idea that stocks or assets that have been doing well are likely to keep doing well for some time. It’s like a car that’s already speeding up—it’s easier to stay fast than to start from a stop.

- Ranking: By comparing the performance of different stocks, relative strength ranks them. The best-performing ones get a higher rank. This helps you focus on the strongest investments, so you’re not guessing which ones will do well in the future.

- Comparative Analysis: This means comparing one investment to others to see which is performing better. By looking at how an investment compares to the market or similar assets, you can identify which ones are on the rise.

Why is Relative Strength Better Than Other Methods?

Many traditional investment methods focus on finding stocks that are undervalued or have great potential for future growth. While these approaches can work, they often require a lot of guessing. For example, value investing depends on predicting when a stock’s price will rise, and growth investing bets on companies that might do well in the future.

Relative strength takes a different approach. It doesn’t try to predict the future—it simply focuses on what’s working right now. By investing in stocks that are already doing well, you align yourself with the winners, which reduces guesswork and increases your chances of success.

This strategy helps you avoid betting on stocks that might not recover or companies that are just hype. Instead, it encourages you to invest in what’s already performing well.

Common Mistakes to Avoid in Relative Strength Investing

While relative strength is a powerful strategy, there are some common mistakes that can lead to losses. Here’s what to watch out for:

- Chasing Quick Gains: Sometimes, a stock might suddenly spike in price, but that doesn’t always mean it will keep rising. Be careful not to get excited by a short-term rise—it could just be a temporary blip.

- Ignoring the Bigger Picture: It’s important to consider things like economic trends, industry changes, or news events that might affect your investments. Relative strength alone won’t give you the full picture.

- Overloading Your Portfolio: It might be tempting to put all your money into the best-performing stocks, but it’s important to maintain balance. Overloading your portfolio with similar investments can leave you exposed if things change quickly.

- Poor Timing: Timing is crucial. Buying a stock too late or holding onto it too long when the trend is reversing can hurt your returns.

Avoiding these mistakes will help you make better decisions and protect your portfolio from big losses.

Real-Life Examples of Relative Strength Success

Many successful investors use relative strength to guide their decisions. Here are a couple of examples:

- William J. O’Neil: He created a strategy called CAN SLIM, which uses relative strength to pick winning stocks. This method has helped many investors find successful stocks over the years.

- Momentum Investing Funds: Some investment funds use relative strength to pick the best stocks, and they’ve been able to outperform the market consistently. This shows that relative strength is not just a theory—it works in the real world.

How to Use Relative Strength in Your Portfolio

One of the best things about relative strength is that it can be combined with other strategies. Here’s how you can make it part of your investing plan:

- Combine Momentum with Value: You can use relative strength to find stocks that are doing well and pair them with undervalued stocks that have good potential. This can help you get the best of both worlds—growth and value.

- Sector Rotation: Sectors (like technology or healthcare) perform differently at various times. Relative strength can help you move your investments to the strongest sectors, giving your portfolio the best chance of success.

- Position Sizing: Once you’ve identified your top-performing stocks, you can invest more in those while keeping a smaller portion of your portfolio in weaker stocks. This way, you focus on the winners while still having some diversification.

By adding relative strength to your strategy, you’ll be able to build a smarter, more balanced portfolio that adapts to market changes.

Case Study of HDFC BANK : The Power of Relative Strength in Action

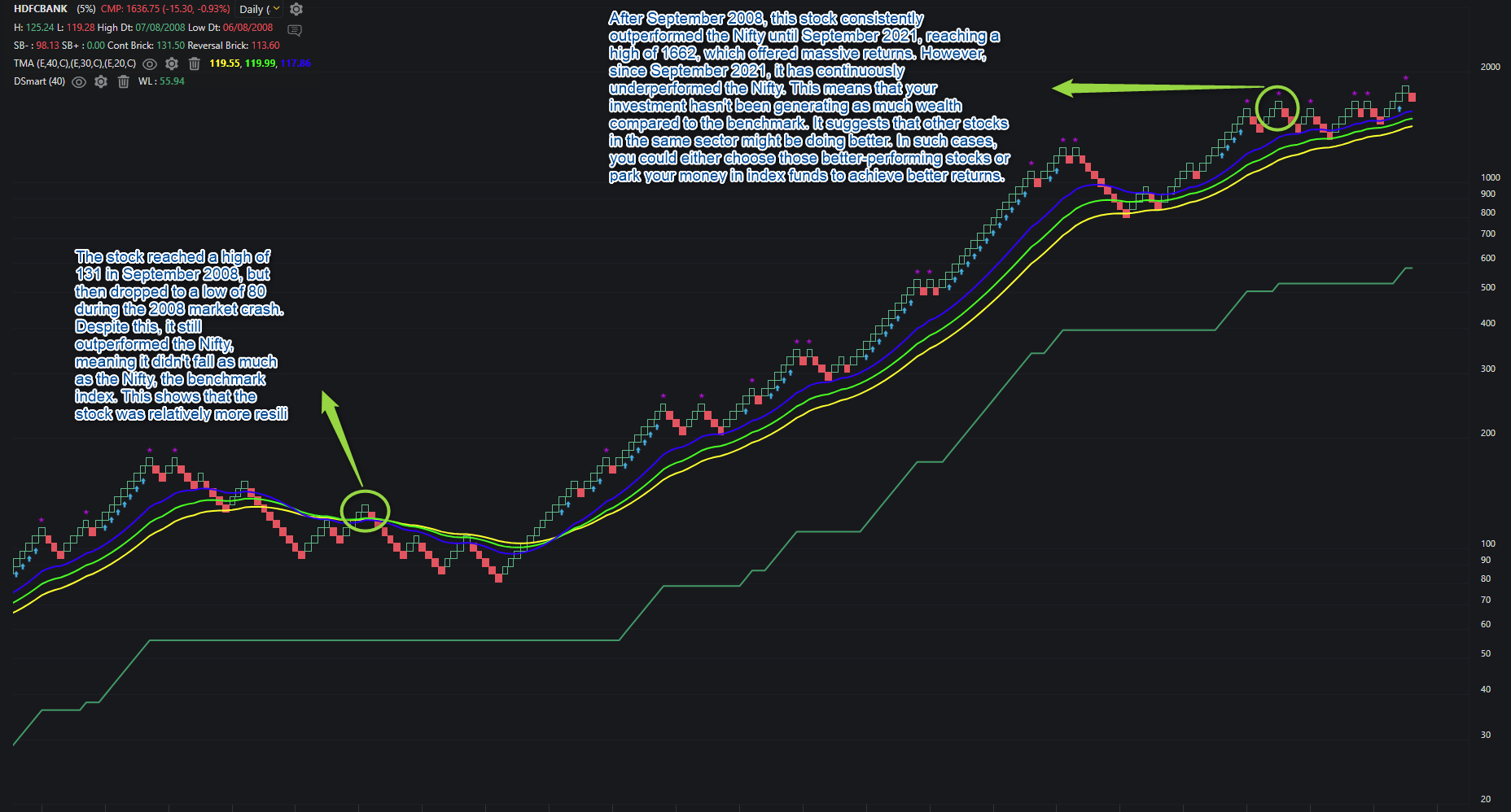

Let’s look at a real example of relative strength in action: HDFC Bank. Back in 2008, during a big market crash, HDFC Bank’s stock price dropped, but it still performed better than the market as a whole. This was a sign of its relative strength, and it continued to perform well over the next decade.

Relative Strength Chart of HDFC BANK :

Price Chart of HDFC BANK since 2008

Between 2008 and 2021, the stock rose from ₹80 to ₹1662—a huge increase. By focusing on relative strength, investors who recognized this trend made significant profits.

However, things changed in 2021. After reaching a high point, HDFC Bank’s stock started to underperform compared to other stocks in the same sector. This shows how relative strength isn’t permanent—today’s winner can become tomorrow’s loser.

Key Takeaways for Investors

- Relative Strength is Always Changing: A stock that’s doing well today might not be the best tomorrow. That’s why it’s important to keep checking and adjusting your investments.

- Re-Evaluate Regularly: If a stock stops outperforming, it could be time to move your money elsewhere. Regularly checking your investments helps you stay on top of market trends.

- Simple Solutions: If you’re not sure where to start, investing in index funds is an easy way to ensure you’re putting your money in a basket of strong, diverse investments. This can help you avoid holding onto underperforming stocks.

Conclusion: Start Using Relative Strength for Smarter Investing

Relative strength is a proven strategy that can help you pick the best investments by focusing on what’s working right now. It takes the guesswork out of investing, helping you make data-driven decisions that lead to better returns.

If you’re new to investing, relative strength might be the strategy you need to grow your portfolio. Start small, track your investments, and watch your portfolio evolve with the market’s trends. Over time, this approach will help you become a smarter, more successful investor.

So, the next time you’re thinking about making an investment, remember: it’s time to stop guessing and start following the strength!