Probability: The Mathematics Chapter That Can Transform Your Trading and Life

Introduction:

Imagine being able to approach each decision in life with a clear understanding of the odds. What if you could assess the likelihood of an outcome, not just based on gut feelings but through a structured approach? This is the power of probability. And in the world of trading, applying probability is one of the most important skills a trader can develop.

In the beginning, trading might seem like a series of random wins and losses, but with the right mindset, it can become much more predictable. And the secret lies in embracing a probability mindset. This concept isn’t just useful for traders—it can bring clarity and confidence to various areas of life as well. By learning to think in probabilities, you can make smarter decisions, reduce emotional stress, and better manage risks.

But what exactly does it mean to think in probabilities, and how can this mindset help improve your trading and life? Let’s dive deeper.

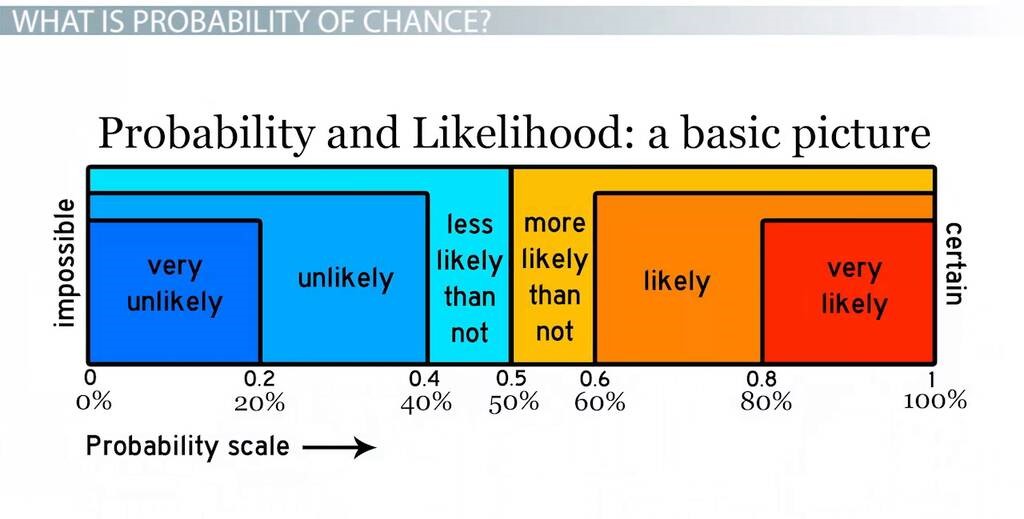

What is Probability?

At its core, probability is simply the measure of how likely something is to happen. In everyday life, we see probability all around us. If you’ve ever heard someone say, “There’s a 60% chance of rain tomorrow,” or “This team has a 70% chance of winning,” you’ve heard probability at work. These percentages reflect the likelihood of different outcomes, but remember, probability never guarantees a specific result. Things can always change unexpectedly.

Take a look at sports, for example. In football, a team might be leading by a few points with just a few seconds left in the game. Despite the odds, it only takes one play—a last-minute goal or a stunning touchdown—to change the outcome. This unpredictability is part of what makes probability so powerful: it helps us make educated guesses about the future but leaves room for surprises.

Why Is Probability So Important in Trading?

Trading, at its heart, is a game of probabilities. When you enter a trade, you’re betting that an asset will move in a certain direction. But this move isn’t guaranteed. The market is unpredictable, and no one can be sure of the outcome. That’s where the power of probability comes in.

In trading, you don’t just rely on hope or gut feelings. Instead, you assess the odds. Every decision you make—whether it’s buying, selling, or holding a position—is based on probabilities. Understanding how to calculate these probabilities and using them in your strategy can make a significant difference in your trading success.

Think about it this way: Imagine you’re betting on a coin flip. The probability of heads or tails is 50%. But if you make that bet over and over, the long-term result will likely be close to an even split. The key to success in trading is thinking in similar terms. The more data and analysis you use to estimate the odds, the better your chances of success.

How Does Probability Work in Trading?

When it comes to trading, you can think of every trade as a potential “bet” on the market. But unlike a coin flip, trading involves analyzing multiple factors that affect the likelihood of a particular outcome. The goal is to assess the probability of success and failure, making informed decisions rather than relying on guesswork.

Let’s break it down with an example. Imagine you’re analyzing a stock that’s currently trending upward. In this case, you might estimate that there’s a higher probability of the stock continuing to rise, given the general market conditions and the current trend. This makes it a favorable time to buy. However, just because the market is bullish doesn’t mean every trade in that direction will succeed. Sometimes the market can reverse suddenly, causing the stock price to fall and hitting your stop loss.

In this case, the probability of success might be higher, but there’s still a chance of failure. Understanding this dynamic is what makes probability so powerful—it helps you recognize the uncertainty inherent in every trade, even when the odds seem favorable.

In a bullish market, you’d likely have a higher chance of success with a long trade (buying the stock). But even then, you must acknowledge the possibility of losing. On the other hand, in a bullish market, short trades (betting that the stock will decrease in value) are generally riskier, but that doesn’t mean they are always doomed to fail. A sudden market shift or unexpected news can cause the stock to decline, making a short position unexpectedly profitable.

This highlights a key principle: probability is not about guaranteeing a win, but about stacking the odds in your favor. By carefully assessing the factors influencing the market, you can make smarter decisions and improve your chances of success.

The Key to a Probability Mindset in Trading

For many traders, myself included, it took time to understand the importance of a probability mindset. When I first started trading, I made the mistake of treating every trade as a personal win or loss. If a trade failed, I felt defeated; if it succeeded, I felt overconfident. But as I gained more experience, I realized that trading isn’t about perfection—it’s about the process and the long-term probabilities.

A successful trader knows that losses are just part of the journey. In fact, many experienced traders lose more trades than they win. The key is that their winning trades are more significant than their losing ones. When you think in probabilities, you stop focusing on individual outcomes. Instead, you focus on the bigger picture: Is your strategy profitable over time? Are the odds generally stacked in your favor?

Once you begin to embrace this mindset, you’ll stop getting emotionally attached to individual trades. A loss won’t feel like a failure; it will simply be part of the learning process. And over time, this mindset can bring more confidence and clarity—not just to trading, but to every area of your life.

How to Apply Probability in Your Trading Strategy

- Embrace Uncertainty:

Trading is uncertain, and there will always be risks. Once you accept that no trade is ever a sure thing, you’ll stop relying on emotional reactions and start making decisions based on the data at hand. Acknowledge that losing trades are inevitable, and don’t let them derail you. - Focus on the Process, Not Results :

Successful traders understand that their strategy, not individual outcomes, determines their success. Even a good strategy will result in losses from time to time. What matters is whether your strategy has a positive expected value in the long run. - Risk Management is Key:

In trading, it’s not just about finding high-probability trades; it’s about managing the risks associated with each trade. Always use stop-loss orders, and ensure that you’re never risking too much on a single trade. Proper risk management helps protect your capital, even when a trade doesn’t go as planned. - Learn to Review Your Trades:

Track your trades, win or lose, and review them regularly. Look for patterns that can help you refine your strategy and make more informed decisions. Over time, your ability to assess probabilities will improve, and so will your results.

Probability in Life: Beyond Trading

The power of thinking in probabilities doesn’t stop in the world of trading. Once you embrace this mindset, you’ll begin to see how it applies to many situations in your life.

For example, when faced with a big decision—whether it’s a career change, buying a house, or making a personal commitment—you can apply a probability mindset. Instead of stressing over the uncertainty, you’ll analyze the likelihood of different outcomes and make the decision with a clearer understanding of the risks involved. You’ll stop fearing uncertainty and start seeing it as a natural part of the decision-making process.

Conclusion:

Probability isn’t just a mathematical concept—it’s a way of thinking that can transform the way you approach trading and life. By learning to assess the odds and embrace uncertainty, you can make smarter decisions, manage risks, and develop greater confidence in yourself and your decisions.

Trading with a probability mindset isn’t about trying to predict the future with certainty—it’s about making the most informed decisions based on what’s most likely to happen. With time and practice, this mindset becomes second nature, not just in trading but in many aspects of your life. So, start thinking in probabilities today—your future self will thank you for it.

Recent example in SILVER :

If you’ve been trading for a while, you’ve probably encountered traditional Renko charts. These charts are known for their simplicity, showing price movements as a series of blocks or “bricks.” But did you know there’s a more dynamic version of Renko charts called log Renko charts? Unlike traditional Renko charts that use a fixed brick value, Renko log charts apply a percentage of the asset’s value. This makes them much more responsive to the asset’s price movements.

If this concept is a bit confusing right now, don’t worry! I’ll break it down and explain it further. For now, let’s dive into a practical example using Silver to understand how Renko log charts work and how they can enhance your swing trading strategy.

What are Renko Log Charts?

Traditional Renko charts use a fixed price change (e.g., each brick represents a $1 move), which can become less useful when the price of an asset is rising or falling sharply. This is where log Renko charts come in.

In a Renko log chart, instead of having a fixed brick value, each brick represents a fixed percentage of the asset’s price. For example, if you set the chart to display a 1% brick size, each new brick will form only when the price moves by 1% in either direction. This allows the chart to adjust automatically based on the price level of the asset. Essentially, the chart becomes more sensitive when the price is high, and less sensitive when the price is low, which can give a clearer picture of trends.

Don’t worry if this sounds a bit complex right now. Over time, you’ll get the hang of it. But for now, let’s look at how this concept applies to Silver and how it helps with trading.

Applying Renko Log Charts to Silver Trading

Let’s look at an example of how I use Renko log charts to trade Silver. I’ve set up a 3% log Renko chart on the daily time frame for tracking the overall trend, and a 0.25% log Renko chart on the one-minute time frame for swing trading. Here’s how it plays out:

1. Overall Trend with 3% Setting (Daily Time Frame)

Silver has been in a strong bullish trend since February 2023. On the daily time frame, I’m using a 3% log Renko setting, which means that a new brick will form only when the price moves 3% higher or lower. This gives a clear picture of the longer-term trend. As you can see from the chart, Silver has consistently stayed above the triple moving averages (TMA), which act as support levels for the price.

The beauty of using Renko log charts in this way is that they help identify the trend in a very clean and visual manner. The price action on the chart is smoother, and it’s easier to spot if the price is trending up or down. If the price falls below the TMA, it’s a sign of potential weakness. But in this case, Silver has stayed strong above the TMA, which means the bullish trend is still intact.

2. Swing Trading with 0.25% Setting (One-Minute Time Frame)

Now, let’s move to a more active time frame: the one-minute chart. For swing trading, I use a 0.25% log Renko setting. This means that a new brick is formed when the price of Silver moves by just 0.25%, which gives a much finer level of detail in the price action.

As you can see from the chart above, there have been multiple trading opportunities in Silver since January 6, 2024. Each time the price moves enough to form a new brick, it signals a potential entry point for a trade. I’m currently holding an active position in Silver, taking advantage of this trend.

The short time frame allows you to capture smaller price moves, which is ideal for swing trading. With the 0.25% setting, the chart gives you frequent entry signals, making it easier to get into the market at the right time.

Why Use Log Renko Charts for Swing Trading?

The main benefit of using log Renko charts in swing trading is that they adjust to the asset’s price movements. As Silver’s price moves higher, the chart adjusts to reflect these changes, giving you a clearer and more accurate view of the trend. The percentage-based approach helps avoid noise and unnecessary fluctuations, allowing you to focus on the bigger picture and make more informed decisions.

Renko log charts are a powerful tool that can make your trading more dynamic and responsive. By using a percentage-based system instead of a fixed brick value, log Renko charts help you adjust to the price movements of the asset, whether you’re tracking a long-term trend or looking for quick entries in swing trading.

For Silver, using a 3% log Renko on the daily time frame helps me spot the overall bullish trend, while the 0.25% setting on the one-minute chart gives me the flexibility to capture short-term price movements. It’s a great combination that helps me stay in sync with Silver’s price action and make more profitable trades.

In upcoming posts, I’ll dive deeper into how Renko log charts work and how you can apply them to your own trading strategy. Stay tuned!

Conclusion :

If the overall trend is bullish, most bullish trades on smaller time frames may work in your favor. However, this doesn’t mean that every bullish trade will be profitable, as some may hit the stop loss. The same principle applies to short trades.