Trade Like a Fund House: Always Trade the Money, Not the Instrument

Many young traders jump into the markets with boundless enthusiasm but often lack the structured approach that professional fund managers rely on. Fund houses, also known as asset management companies, are masters of systematic trading and investing. By adopting their strategies, even a beginner can build a strong foundation for long-term success. This guide explains how you can trade like a fund house, step by step, in a simple and practical way.

What Does It Mean to Trade Like a Fund House?

Fund houses manage pooled investments from individuals and institutions with the goal of maximizing returns while minimizing risks. Unlike individual traders who might react emotionally to market fluctuations, fund houses operate with discipline, diversification, and data-driven strategies. You too can improve your trading game by incorporating their methods.

Core Principles of Fund House Trading

Here are the key principles that fund houses follow:

1. Research-Driven Decisions

Fund houses rely on teams of analysts to dig deep into market data, financial reports, and economic indicators. Every investment decision is backed by extensive research, ensuring the best odds of success.

2. Diversification

The age-old wisdom of “Don’t put all your eggs in one basket” applies here. Fund houses spread their investments across various sectors, asset classes, and regions to minimize risks.

3. Risk Management

Protecting capital is as critical as growing it. Tools like stop-loss orders, position sizing, and hedging are essential parts of their strategy to reduce potential losses.

4. Long-Term Focus

While many individual traders chase quick profits, fund houses aim for sustainable growth. Their strategies prioritize steady returns over time, even during periods of short-term volatility.

5. Seek Asymmetrical Bets

Fund houses look for opportunities where potential rewards far outweigh risks. This means even if they experience consecutive small losses, one significant win can offset those losses and generate substantial profit.

6. Trade the Money, Not the Instrument

Larry Hite, a pioneer in systematic trading, emphasizes focusing on managing your capital effectively rather than getting attached to specific assets. Whether you’re trading indices, commodities, or forex pairs, the key is understanding how much you’re willing to risk and the potential reward.

Key Takeaway: Don’t stick to one instrument. Instead, find opportunities across various markets and apply a single strategy consistently.

My Approach to Trading Based on above Principles

Here’s an example of how I trade using one setup across different instruments:

- Bullish Entry in Silver

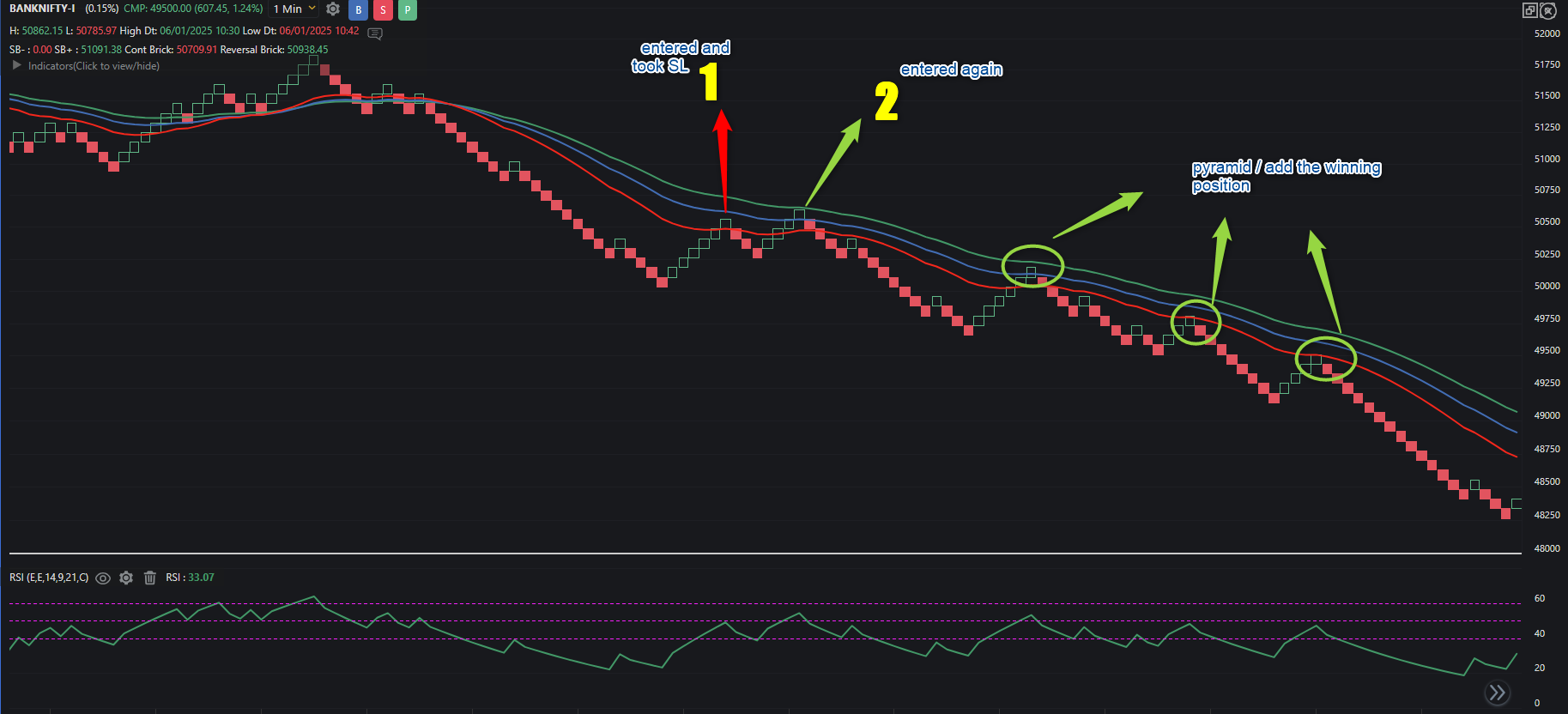

- Bearish Entry in Bank Nifty

The Setup:

- Wait for a triple moving average crossover.

- After the crossover, watch for the price to retrace near the moving averages.

- Confirm the trend with a two-brick reversal:

- For bullish trades, wait for two bullish bricks after retracement.

- For bearish trades, wait for two bearish bricks after retracement.

- Enter the trade with a stop-loss at the low (for bullish) or high (for bearish) of the reversal.

This strategy took me two years of full-time trading to develop. The simplicity lies in sticking to one approach while applying it to various markets.

How to Trade Like a Fund House

Now let’s look at actionable steps to implement these principles:

1. Conduct Thorough Research

Before placing any trade, understand the asset you’re dealing with:

- Study the Instrument: Analyze its behavior over time. How does it react on regular days versus event-driven days? How does it respond to news?

- Technical Analysis: Use tools like moving averages and RSI (Relative Strength Index) to identify entry and exit points.

- Macroeconomic Trends: Track economic indicators such as GDP growth, interest rates, and inflation. These can significantly influence market movements.

2. Diversify Your Portfolio

Diversification helps protect against significant losses:

- Asset Classes: Trade across equities, bonds, commodities, and other instruments.

- Sectors: Engage in trades from different industries like technology, healthcare, and finance.

- Geographies: Explore opportunities in international markets to reduce country-specific risks.

3. Practice Robust Risk Management

To safeguard your capital, follow these strategies:

- Stop-Loss Orders: Predefine your exit levels to limit losses.

- Position Sizing: Allocate only a small percentage (e.g., 1-2%) of your portfolio to any single trade.

- Risk-Reward Ratio: Aim for trades where potential rewards are significantly higher than risks.

4. Stay Disciplined

Discipline separates successful traders from the rest. Here’s how to develop it:

- Stick to your trading plan, no matter the market conditions.

- Avoid emotional decisions driven by fear or greed.

- Regularly review and learn from your trades.

5. Maintain a Long-Term Perspective

Patience is crucial for trading success:

- Ignore short-term market noise and focus on the bigger picture.

- Allow your investments time to grow.

- Reinvest profits to harness the power of compounding.

6. Cut Losses and Ride Winners

- Always cut losing trades quickly and let your winners run.

- Add to your winning trades to maximize profits.

- Remember, small consistent wins don’t equate to real success. Focus on converting your winners into big trades.

Mistakes Young Traders Should Avoid

Even with a solid strategy, avoid these common pitfalls:

1. Overtrading

Trading too frequently increases transaction costs and emotional stress. Focus on quality over quantity.

2. Ignoring Risk Management

Failing to set stop-loss orders or overcommitting capital to a single trade can lead to significant losses. Always prioritize capital protection.

3. Trading on Emotions

Emotional decisions, driven by fear or greed, often lead to poor outcomes. Stick to your strategy and avoid panic-driven actions.

4. Chasing the Herd

Following popular trends without conducting your research can result in bad trades. Make decisions based on data and analysis, not market hype.

Tools and Resources for Young Traders

To trade effectively, leverage these tools:

- News and Analysis: Stay updated with platforms like Bloomberg, CNBC, or Investing.com.

- Trading Journals: Keep detailed records of your trades, including the rationale, outcomes, and lessons learned.

- Educational Content: Learn continuously through books, podcasts, and online courses.

The Benefits of Trading Like a Fund House

Adopting the strategies of fund houses offers several advantages:

- Consistency: A structured approach reduces impulsive decisions.

- Risk Reduction: Diversification and risk management minimize large losses.

- Confidence: Data-backed decisions build confidence in navigating the markets.

Conclusion

Trading like a fund house might sound daunting, but with the right mindset and approach, it’s entirely achievable. Conduct thorough research, diversify your portfolio, manage risks effectively, and maintain discipline and patience. Remember Larry Hite’s golden rule: trade the money, not the instrument. Focus on managing your capital, and the profits will follow.

Trading is a journey of learning and growth. Stay patient, disciplined, and curious. With consistent effort, you can create a strategy that stands the test of time.